The realm of Forex trading is intricate, with liquidity playing a pivotal role in shaping the trading environment. This article delves into the essence of forex liquidity, spotlighting Liquidity Soft Solutions, an array of reputable liquidity providers, the practicality of live solutions, and the strategic utility of forex liquidity indicators.

Understanding Liquidity in Forex

Liquidity, in the forex context, signifies the capacity to buy or sell assets without causing significant price changes. It’s the lifeline that ensures smooth trading experiences, affecting everything from spreads to slippage.

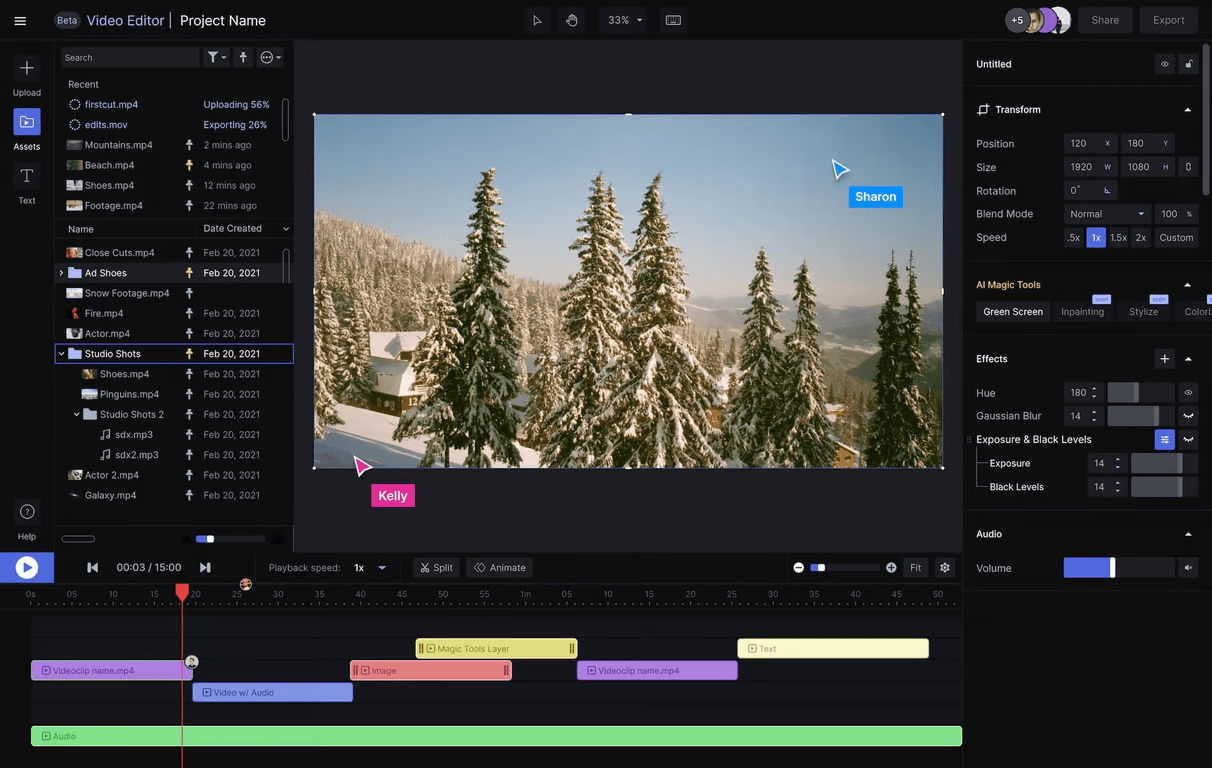

Liquidity Soft Solutions in Forex

Liquidity Soft Solutions forex are innovative platforms designed to enhance market fluidity, offering traders real-time data, reduced slippage, and better price execution. They stand as crucial tools for anyone looking to streamline their trading operations.

Top Forex Liquidity Providers

Selecting a stellar liquidity provider is crucial. This segment introduces a forex liquidity providers list of top-tier providers known for their robust infrastructure, transparency, and competitive spreads, guiding traders toward making informed choices.

Liquidity Soft Solutions Live

Embracing live liquidity solutions equips traders with the agility to respond to market changes instantaneously, a key to maintaining competitiveness in the fast-paced forex market.

Forex Liquidity Indicator

This tool is essential for traders aiming to gauge market depth and liquidity, directly influencing their trading decisions and strategies for optimal entry and exit points.

Integrating Liquidity Solutions

The integration of liquidity solutions into trading platforms can significantly enhance trading efficiency, offering seamless execution and better risk management.

Challenges and Solutions

While the forex market is fraught with challenges like price volatility and liquidity fluctuations, adopting sophisticated liquidity soft solutions live can provide a buffer, ensuring stability and consistency in trading activities.

Choosing the Right Liquidity Provider

This crucial decision impacts a trader’s success. We discuss essential considerations and how to sift through providers to find one that aligns with your trading ethos and requirements.

The Future of Forex Liquidity

Innovation continues to shape the liquidity landscape, with technological advancements promising more refined solutions, ensuring traders can adapt to the evolving market.

Case Studies

We showcase real-world scenarios where traders leveraged liquidity soft solutions to their advantage, highlighting the tangible benefits and enhanced trading outcomes.

Expert Insights

Gaining perspectives from industry veterans can illuminate best practices and strategic approaches to managing liquidity effectively, a treasure trove of wisdom for ambitious traders.

Conclusion

Navigating the forex market’s liquidity complexities can be daunting, but with the right tools and knowledge, traders can harness these nuances to their advantage. The integration of sophisticated liquidity solutions, like Liquidity Soft Solutions, alongside a thorough understanding of liquidity providers and indicators, can significantly elevate one’s trading journey.

FAQs

What is the significance of liquidity in forex trading?

Liquidity is crucial for enabling smoother transactions, better pricing, and reduced slippage, directly impacting trade execution and profitability.

How do Liquidity Soft Solutions enhance forex trading?

They provide real-time data, improve price execution, and minimize slippage, thereby optimizing the trading experience.

What should I look for in a forex liquidity provider?

Look for reliability, transparency, competitive spreads, and the ability to provide deep liquidity pools.

How can a forex liquidity indicator benefit my trading strategy?

It helps in understanding market depth and liquidity, aiding in better decision-making for entry and exit strategies.

What are the future trends in forex liquidity solutions?

Expect more technological innovations, tailored solutions, and advanced analytics to drive better decision-making and enhance market liquidity.