Recently, Bitcoin (BTCUSD) has started to show sensitivity to economic news that typically affects traditional financial assets. This transformation, turning Bitcoin from an unpredictable alternative asset into a more predictable financial instrument, is marked by the emergence of Bitcoin ETFs and increased regulatory pressure. Why is this happening, and what does it mean for the future of Bitcoin?

Bitcoin and traditional markets are becoming more strongly correlated. Bitcoin’s reaction to macroeconomic indicators and central bank policies illustrates its increasing alignment with equity markets. Historically, Bitcoin has been seen as “digital gold,” an asset that doesn’t correlate with traditional market movements and serves as a safe haven. However, especially after the COVID-19 pandemic crisis, investors began to view Bitcoin through the same macroeconomic lens as stocks.

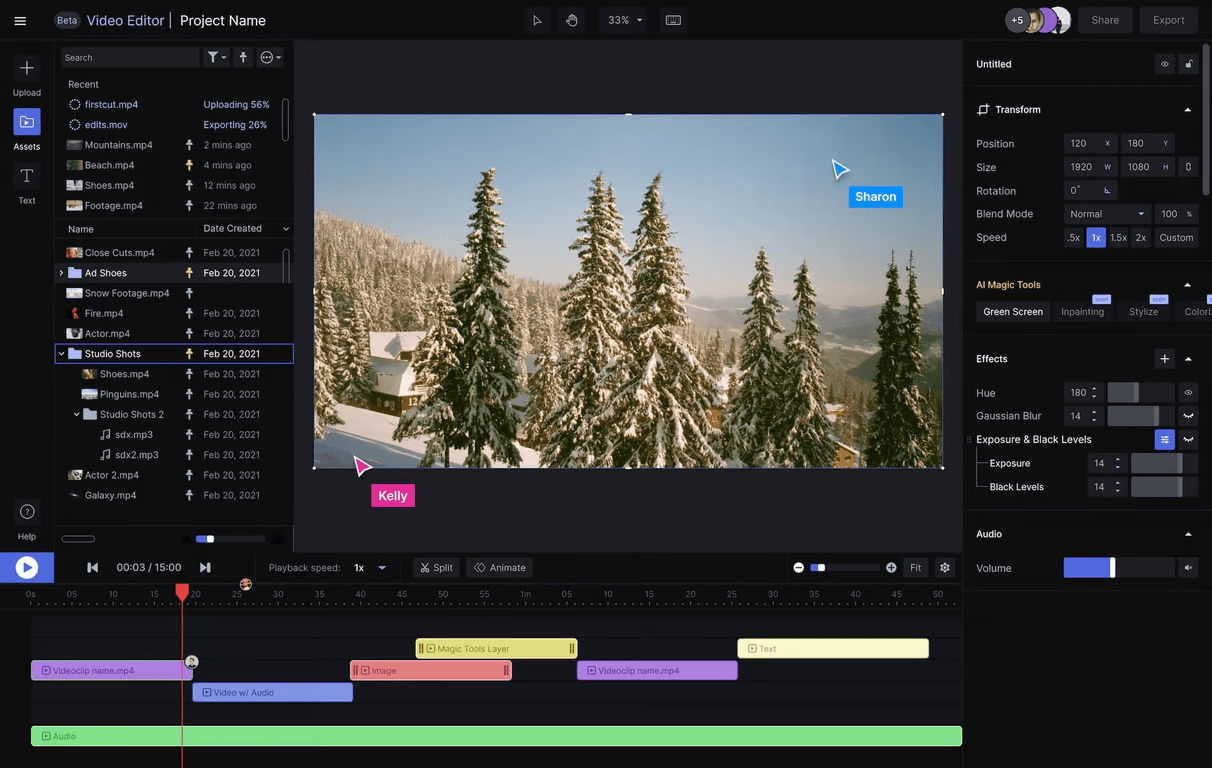

The influence of ETFs and Wall Street has increased significantly over the past year. The launch of the Bitcoin ETF provided Wall Street institutional investors with a simple and familiar mechanism for investing in Bitcoin, increasing liquidity, and integrating Bitcoin with traditional financial markets. These tools allow investors to trade Bitcoin without directly owning coins, avoiding the associated technical and regulatory complexities.

The changing perception of investors is fundamental to Bitcoin being seen as a typical asset. The previously missing connection with other assets has begun to emerge as more investors interpret Bitcoin from the perspective of financial theory and investment practice. Thus, Bitcoin’s reaction to macroeconomic events has become more pronounced.

Global macroeconomic risks exert pressure on traders and investors, strengthening the link between traditional markets and the emerging cryptocurrency sector. Traders integrated into the global financial system constantly assess risks based on macroeconomic data and the actions of central banks. This ability to analyze global economic trends allows them to predict Bitcoin trends in a new context, where it is no longer an isolated “sandbox” for crypto enthusiasts. Additionally, the volume profile of Bitcoin trading now reflects patterns similar to those seen in traditional markets, further indicating its integration.

In simple terms, Bitcoin is exposed to the same macroeconomic factors as traditional assets. Expectations of the Federal Reserve’s actions, such as rate changes and quantitative easing or tightening, as well as labor market reports, significantly impact Bitcoin price movements.

The “traditionalization” of Bitcoin reflects its growing integration into the mainstream financial system and its alignment with stock market logic. This may indicate a decrease in Bitcoin’s independence from traditional assets and a recognition of its importance in the broader investment community. The impact of this change on the future of cryptocurrency remains uncertain. This evolution will undoubtedly be interesting for both market participants and observers of financial innovations.

On May 15, Bitcoin’s value jumped along with stock prices following news of a lower-than-expected Consumer Price Index in the United States. Bitcoin rose after a report showed a smaller-than-expected increase in U.S. employment, renewing investor expectations of a Fed interest rate cut, which in turn increased the attractiveness of speculative assets. This rally helped offset most of the losses recorded earlier in the week amid concerns over the Fed’s tougher stance and declining demand for exchange-traded funds. Technically, if Bitcoin breaks through the current resistance of $67,000, it could pave the way for a new all-time high. The main support level of $60,000 continues to show strength.