Choosing the best Demat account is crucial for investors who wish to trade and invest in the stock market. With numerous options available, selecting the right one can be challenging. Here are various tips and factors you should consider when choosing the best Demat account to ensure a smooth and profitable investment journey.

Understand Your Investment Needs

Before selecting a demat account, understand your investment needs. Are you a beginner looking to invest in mutual funds or an experienced trader dealing with high-frequency trading? Your investment goals will determine the features and services you need from a Demat account. For instance, if you plan on frequent trading, look for accounts offering low transaction fees and fast execution times.

Compare Demat Account Opening Charges

The Demat account opening charges can vary significantly between different providers. Some offer free account opening, while others charge a nominal fee. Compare these charges and understand what you’re getting for the price.

A lower fee might seem attractive but could come with fewer features or higher transaction costs later. Religare Broking, for example, offers competitive Demat account opening charges and various features catering to beginners and seasoned investors.

Evaluate Annual Maintenance Charges (AMC)

Annual Maintenance Charges (AMC) are fees you pay yearly to maintain your Demat account. These charges can vary widely. Some brokers may offer the first year free or charge very low fees for the initial years. Consider these charges over the long term. An account with a low AMC is beneficial, especially for long-term investors who do not trade frequently.

Check Transaction Fees

Transaction fees are the costs of buying and selling securities through your demat account. These fees can include brokerage charges, a percentage of the transaction value or a flat fee per trade. Choosing a provider with reasonable transaction fees is important to maximise your investment returns.

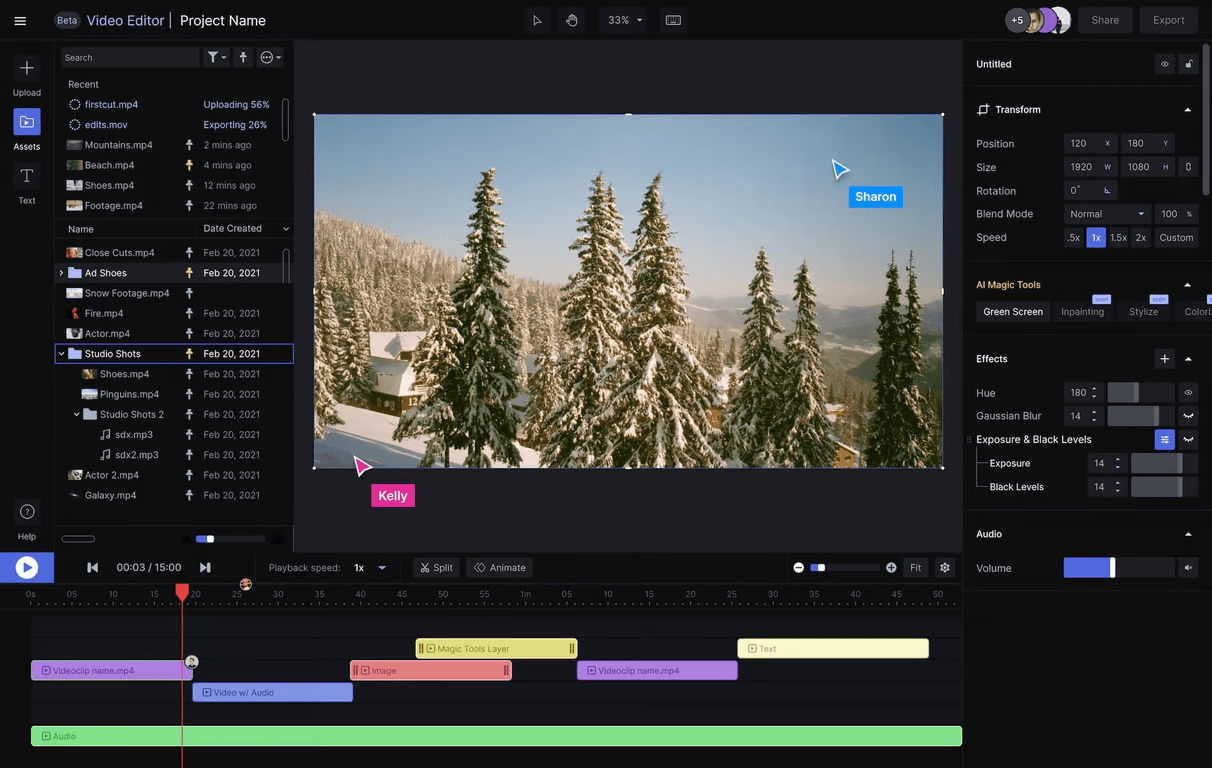

Look for a User-Friendly Platform

Another critical factor is the usability of the demat account platform. A user-friendly interface makes executing trades, tracking investments, and analysing market trends easier. Look for platforms that offer robust mobile apps and web interfaces with easy navigation and comprehensive tools.

Consider Customer Service

Reliable customer service is essential when dealing with any financial service. Ensure that the Demat account provider offers prompt and effective customer support. This can be particularly helpful when you encounter issues or have transaction queries.

Research the Reputation of the DP Provider

Look for reviews and ratings from current and past users to gauge their experiences. A DP with a solid track record of reliability, transparency, and security is vital.

Check for Additional Services

Additional services offered by the Demat account provider can add significant value. These services may include research reports, investment advice, portfolio management, and educational resources. Access to quality research and advice can help you make informed investment decisions.

Security Measures

Security is paramount when dealing with financial transactions. Ensure the Demat account provider employs robust security measures to protect your investments and personal information. Features like two-factor authentication, encryption, and regular security audits are essential.

Ease of Demat Account Opening

The process of Demat account opening should be designed to be as user-friendly and convenient as possible, ensuring a smooth start to your investment journey. Here’s a closer look at what makes the account opening process hassle-free and efficient:

- Simple Online Application: An intuitive online application process that guides you through each step is essential. This includes clear instructions and easy-to-navigate forms that reduce the time and effort required to open an account.

- Minimal Documentation Requirements: Providers that require minimal documentation for the account opening process simplify and expedite the procedure. Essential documents typically include identification proof, address proof, and PAN card details.

- Digital Verification: Incorporating digital verification methods such as e-KYC (electronic Know Your Customer) can significantly speed up the process. This allows for instant verification of your identity and address using Aadhaar-based authentication.

- Doorstep Services: Some providers offer doorstep services where a representative visits your home or office to collect the required documents. This adds a layer of convenience, especially for those who prefer not to visit a branch.

- 24/7 Customer Support: Round-the-clock customer support can assist you with any queries or issues during the account opening process. Whether through phone, chat, or email, responsive support ensures that help is always available when needed.

- Transparent Fee Structure: A transparent fee structure with no hidden charges provides clarity and helps you understand the costs involved in maintaining the account. This includes account opening fees, annual maintenance charges, and transaction fees.

- User-Friendly Platform: It is vital to have a user-friendly platform with a seamless interface to complete the application process. This includes features such as progress tracking, save-and-resume options, and easy document submission.

- Instant Account Activation: Some providers offer instant account activation once the verification process is complete. This means you can start trading almost immediately without any unnecessary delays.

Conclusion

Choosing the best Demat account involves carefully considering various factors, including charges, platform usability, customer service, and additional services. By understanding your investment needs and researching your options thoroughly, you can find a Demat account that best suits your requirements.

Make an informed decision to ensure a smooth and profitable investment experience.