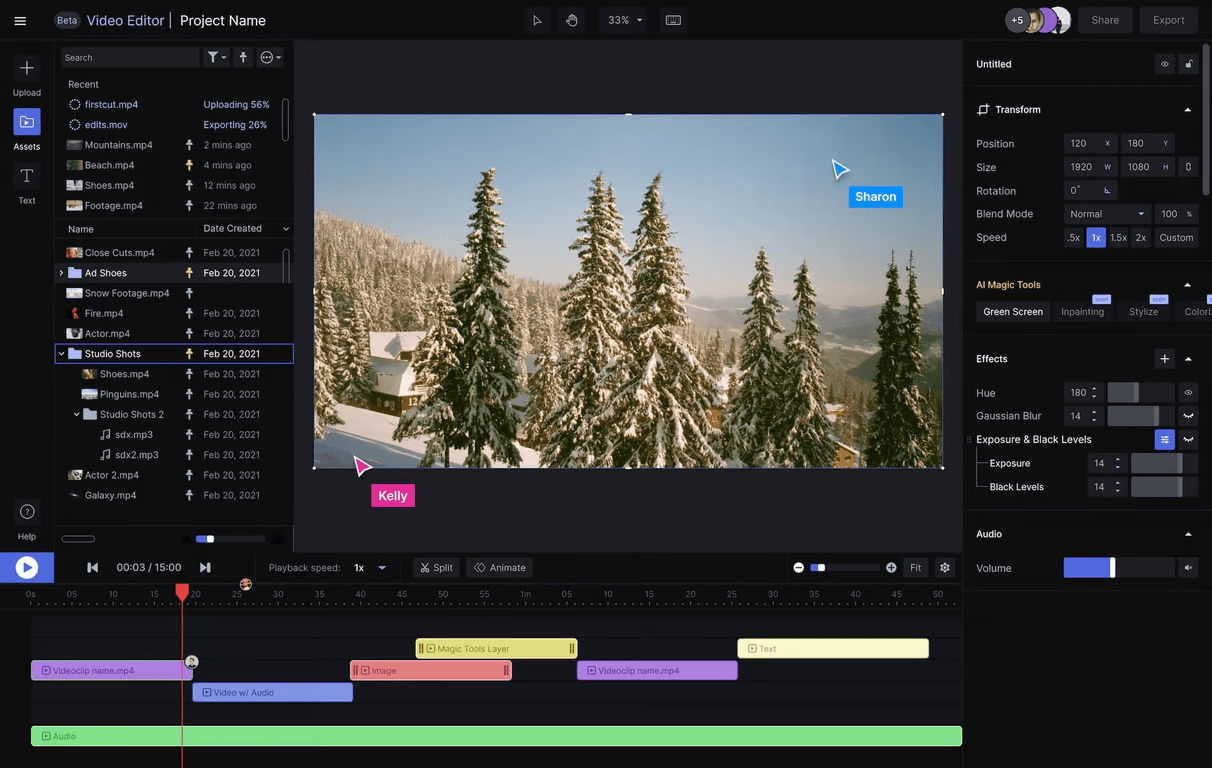

Micron Technology (NASDAQ:MU), one of the leading semiconductor memory manufacturers, recently released a quarterly report that led to an unexpected 7% decline in its share price. This may seem paradoxical at first, especially considering the company reported revenue of $6.81 billion, 82% higher than the same period last year and above analysts’ expectations set at $6.67 billion. Analyzing this situation, we can see that the market trends are changing. Investors are becoming more focused on projected results rather than current financial performance.

For many tech sector stocks, including Micron, the ratio of the company’s current condition to its future prospects is becoming a critical valuation factor. The company forecasts revenue of $7.6 billion for the next quarter, which aligns with analysts’ expectations but does not exceed them. This was a key factor in disappointing investors who had expected Micron’s forecast would surpass market estimates. Consequently, the company’s shares declined.

This trend indicates that investors seeking companies that not only achieve strong financial results in the present but also show optimistic forecasts for the future. Many other tech companies, including Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), and AMD (NASDAQ:AMD), have experienced similar outcomes.

In his speech following the report’s release, Micron CEO Kevin McMillan expressed confidence that the company will benefit from the market growth driven by increased demand for memory for artificial intelligence systems. This argument is supported by the fact that Micron sold the latest HBM3E chips worth $100 million last quarter and expects to reach several hundred million US dollars in the current quarter.

Micron expects to raise several billion US dollars from the implementation of HBM3E throughout fiscal year 2025, which lasts until next August. This product segment could be a significant growth driver for the company, given its importance for AI solutions and high margins. In addition, in the current fiscal year, which ends this August, Micron plans to spend $8 billion on building new facilities, upgrading existing ones, and purchasing equipment. In the next fiscal year, capital expenditures will increase significantly due to the need to finance the construction of new facilities in Idaho and New York State. The first sites will begin producing commercial products by fiscal year 2027, with the second joining a year later.

These events highlight the importance of a long-term perspective for Micron shareholders. In the short term, stocks may fluctuate due to revenue forecasts that don’t meet expectations. However, the company’s long-term potential remains high, especially given its position in the AI memory segment. Investors should consider the market’s main growth trends and the company’s strategic position in it. The price is just holding on to the volume profile point of control, the main support for $128. The main goal of buyers is to break through the resistance of $138 to return to the original prices and move to the historical maximum.

Is it worth holding company shares? Yes, provided you are prepared for short-term fluctuations. Micron has every chance of successful long-term development due to significant investments in innovative products such as HBM3E and adaptation to the challenges and opportunities of the AI market. Thus, despite short-term disappointments and declining stock prices, Micron’s long-term growth potential remains significant, making the company attractive to strategic investors.