Margin trading allows investors to borrow funds from a broker to purchase additional securities, increasing their potential returns. However, this strategy comes with higher risks, as losses can be magnified. To succeed in margin trading, it is essential to adopt effective strategies that minimise risk while maximising profit potential. This guide explores the top strategies for using the margin trading facility and how knowledge of the types of derivatives market can complement your margin trading approach.

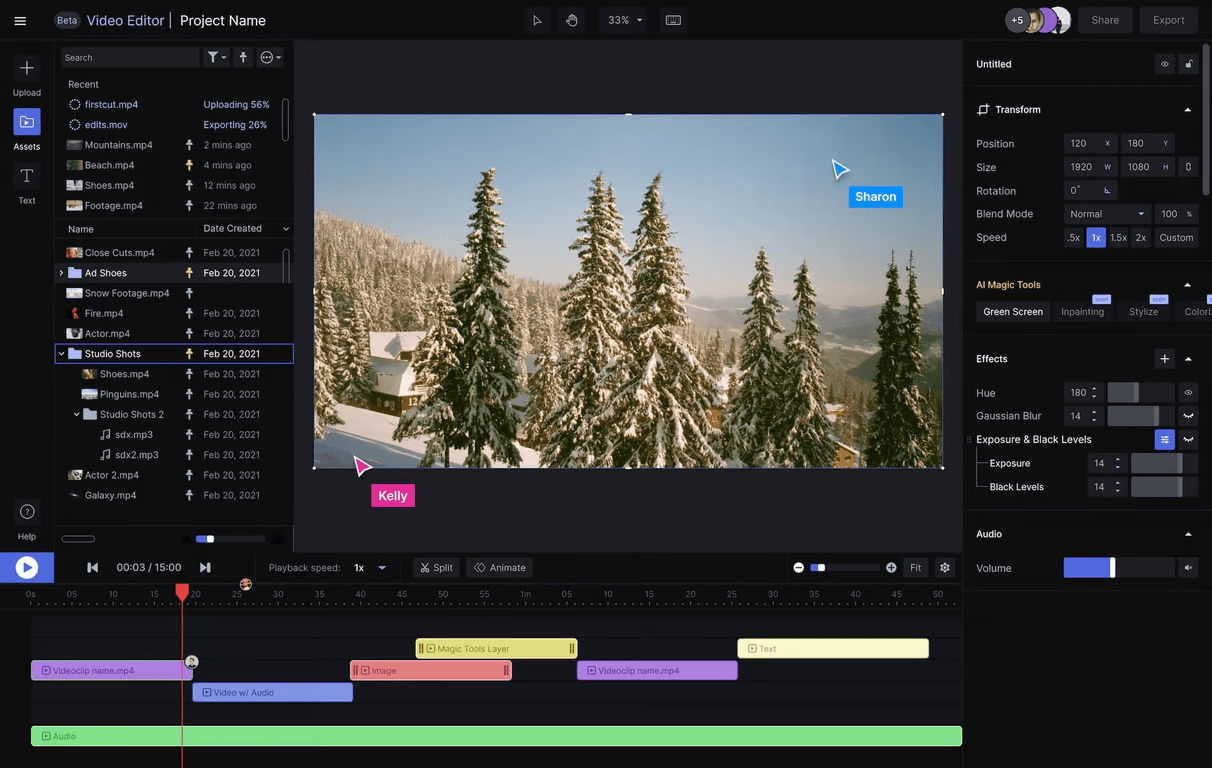

Understanding margin trading facility

A margin trading facility enables investors to borrow capital from a broker to purchase more stocks than they could with their available cash. The purchased securities act as collateral for the loan, and the borrowed amount must be repaid, often with interest. Margin trading amplifies both potential gains and losses, making it crucial to manage risks effectively.

- Leverage: By using margin, you can control a larger amount of stocks with a smaller initial investment.

- Increased buying power: Margin trading allows you to diversify your portfolio and invest in a broader range of securities.

- Potential for higher returns: If the market moves in your favour, you can generate substantial profits with relatively little capital.

Types of derivatives market and their role in margin trading

Derivatives are financial instruments that derive their value from an underlying asset, such as stocks, bonds, commodities, or currencies. The types of derivatives market include futures, options, and swaps.

How derivatives complement margin trading?

- Futures contracts: These allow traders to buy or sell an asset at a predetermined price on a future date. Margin traders can use futures to hedge their positions against adverse price movements.

- Options contracts: These give traders the right, but not the obligation, to buy or sell an asset at a specific price. By using options, margin traders can limit their downside risk while maintaining the potential for profits.

Top strategies for margin trading success

To use a margin trading facility effectively, traders must implement strategies that manage risk and enhance profit potential. Below are some key strategies to consider:

1. Limit leverage

While margin trading provides the opportunity to borrow funds, overleveraging can lead to significant losses if the market moves against you. A smart strategy is to use less than the maximum allowable leverage. For example, instead of borrowing the full 50% of your buying power, consider borrowing only 25%. This limits your risk exposure while still benefiting from the advantages of margin trading.

2. Diversify your portfolio

Diversification is a fundamental strategy for managing risk in margin trading. By investing in a range of stocks across different sectors, you reduce the impact of a downturn in any single investment. Diversification also applies to using different types of derivatives market instruments, such as futures and options, to hedge positions.

3. Use stop-loss orders

A stop-loss order is a critical tool for margin traders. It automatically sells your securities when they reach a predetermined price, limiting your losses in case the market moves against you. Stop-loss orders provide peace of mind by ensuring that your losses do not spiral out of control, especially when trading on margin.

4. Monitor margin requirements

Margin accounts have maintenance requirements, meaning you must maintain a minimum equity level in your account. If your equity falls below this level, you may face a margin call, which requires you to deposit more funds or sell some securities. Always monitor your margin account carefully to avoid unexpected margin calls.

5. Trade in liquid markets

Liquidity is important when trading on margin because it allows you to enter and exit trades quickly without significantly affecting the price. High liquidity ensures tighter spreads, which is crucial for minimising transaction costs. Focus on trading in highly liquid markets, such as major stock indices or blue-chip stocks.

6. Understand market trends

Margin trading magnifies both profits and losses, so understanding market trends is essential. Use technical and fundamental analysis to track market movements and identify potential entry and exit points. Align your margin trades with broader market trends to maximise the likelihood of success.

Key considerations for margin trading

Before engaging in margin trading, there are several important factors to consider:

1. Risk tolerance

Margin trading is not suitable for everyone, especially risk-averse investors. Understand your risk tolerance and only use margin trading if you can afford to lose the amount borrowed without jeopardising your financial position.

2. Cost of borrowing

While margin trading offers the advantage of leverage, it also comes with costs, such as interest on the borrowed funds. These costs can eat into your profits, especially if you hold positions for an extended period. Always factor in the cost of borrowing when calculating potential returns.

3. Margin calls

A margin call occurs when the value of your account falls below the required maintenance margin. In this case, the broker will demand additional funds to bring the account up to the required level. Failure to meet a margin call may result in the forced sale of your assets, leading to significant losses.

4. Market volatility

Margin trading is particularly risky in volatile markets, where prices can swing rapidly. Volatility increases the chances of triggering a margin call or stop-loss order, making it essential to remain cautious during periods of heightened market activity.

Conclusion

A margin trading facility offers the potential for greater returns through leverage, but it also comes with increased risk. By implementing strategies such as limiting leverage, using stop-loss orders, and diversifying your portfolio, you can use margin trading successfully. Additionally, understanding the types of derivatives market can further enhance your trading approach by providing tools for hedging and risk management. Keep key considerations in mind, and always monitor your account to ensure you can handle the risks associated with margin trading.