The market is full of payment solutions for Facebook Ads, but not all of them meet the platform’s specific requirements. This article highlights the top five virtual cards designed to help you efficiently run ad campaigns on Facebook Ads. These services are ideal for both media buying teams and individual advertisers, ensuring minimal declines and offering plenty of benefits.

1. PSTNET

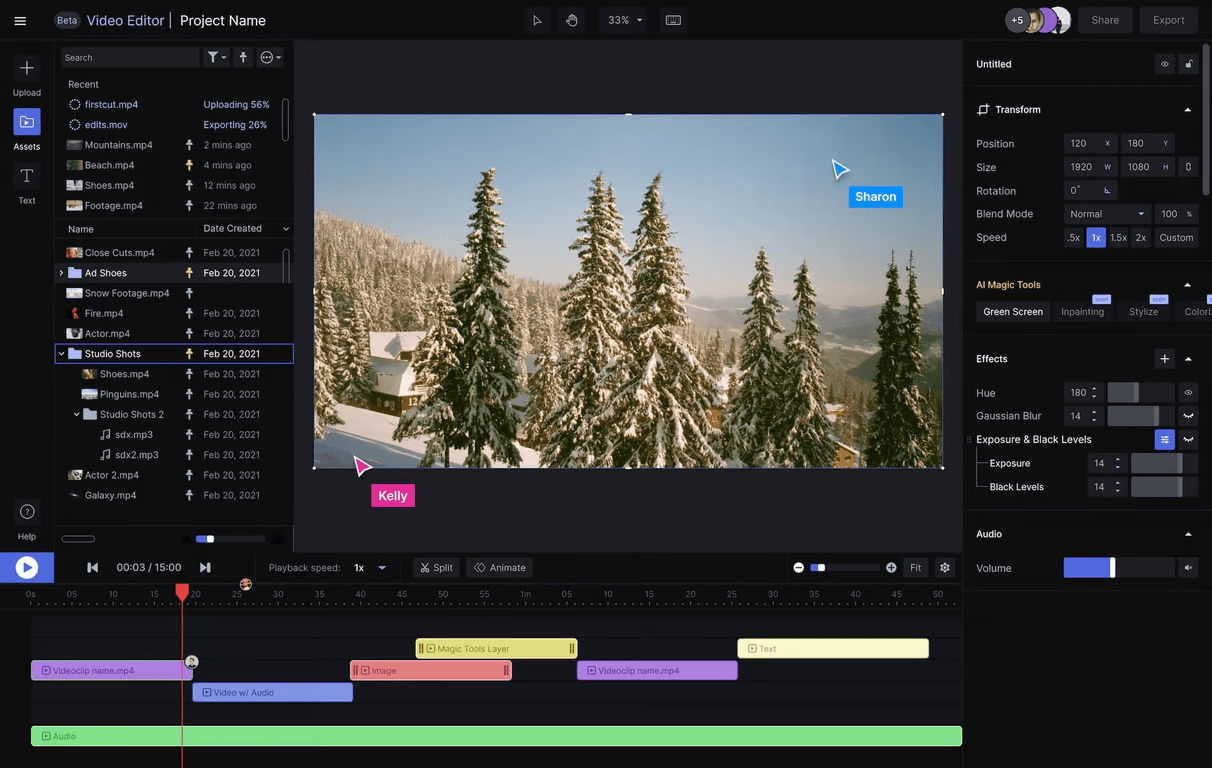

PSTNET virtual cards are built specifically for media buying. The platform offers cards tailored for various ad platforms, complete with pre-configured settings. These Visa/Mastercard-based cards come with optimized BINs, making them a perfect fit for Facebook Ads.

To choose a virtual card for Facebook Ads on the platform, you just need to register and issue a card in your personal account. Cards can be issued in unlimited quantities there. Additionally, the personal account offers tools for managing multiple cards, team collaboration, and expense analytics.

One of the main advantages of PSTNET cards is the absence of fees for transactions, withdrawals, and operations with blocked or frozen cards.

Additionally, the platform offers a PST Private program with a 3% cashback on ad spending. Membership can be obtained as a standard subscription plan. Besides cashback, there are other perks for media buyers — free cards (up to 100 cards can be issued monthly) and a low 3% fee for balance replenishment.

Features:

- BINs: Over 25 trusted BINs from U.S. and European banks.

- BIN Checker: Free BIN verification tool on the website.

- Fast registration: Sign up using Apple ID, Google, Telegram, WhatsApp, or email—takes less than a minute.

- Funding options: Supports 18 cryptocurrencies (BTC, USDT TRC20/ERC20, etc.), SWIFT/SEPA transfers, and Visa/Mastercard.

- Customer support: Available 24/7 via Telegram, WhatsApp, or live chat.

2. Karta

Karta is a financial service specializing in virtual cards for popular ad platforms. With support for Visa and Mastercard, the service offers eight trusted BINs from U.S. banks, including options tailored for Facebook Ads.

To issue cards, users must register and wait for account approval. Once approved, you’ll gain access to a dashboard with tools for team collaboration and budget management.

While there’s a 1% + $0.50 transaction fee, the absence of funding fees balances this out.

Features:

- BINs: Eight trusted BINs from U.S. banks.

- Registration: Simple form submission and account approval process.

- Funding: All cards are funded via a centralized account balance.

- Support hours: 24/7 live chat assistance.

3. Spendge

Spendge offers a robust platform for creating and managing virtual cards optimized for ad platforms, particularly Facebook Ads. Users can create an unlimited number of cards after registration and system approval.

Spendge provides real-time transaction tracking and team account management with role assignments. The transparent fee structure is a standout feature: no internal transfer fees, 1% + $0.30 transaction fees, and top-up fees starting at 3%.

Features:

- BINs: Ten BINs from U.S. and European banks.

- Registration: A straightforward process where account status updates are visible in real time.

- Funding options: USDT (TRC20/ERC20), BTC, SWIFT/SEPA transfers, Visa/Mastercard, Capitalist, and partner services.

- Support: Accessible via Telegram or live chat.

4. FuncWallet

FuncWallet is a digital platform combining financial management tools with a cryptocurrency wallet. It also offers virtual cards optimized for media buying, including Facebook Ads.

The registration process is lengthy, requiring full data verification, and users often need to contact support to expedite approval. However, the minimalist dashboard simplifies card management and transaction tracking.

Fees are based on transaction size and decline rates: top-up fees start at 3%, while transaction fees start at 1.5%.

Features:

- BINs: Three BINs from European banks.

- Registration: Submit user information and wait for account approval.

- Funding options: USDT (TRC20/ERC20), Visa/Mastercard, and internal transfers between wallet users.

- Support: Available through a website form, though response times can be lengthy.

5. 4×4

4×4 specializes in virtual cards for ad payments, allowing unlimited card issuance. Registration is fast, requiring only basic personal information, and provides immediate access to tools for team collaboration and spending reports.

However, users should note strict limits: each card must process at least $10,000 per month, and inactivity for 30 days results in automatic card closure. Additionally, a 3% fee applies to declined transactions.

Features:

- BINs: Eight BINs from U.S. and European banks.

- Funding options: USDT (TRC20/ERC20), SEPA transfers, and Visa/Mastercard.

- Registration: Provide your name, email, phone number, and password.

- Support: 24/7 Telegram chat assistance.

To sum up

Choosing the right virtual card for Facebook Ads is crucial for ensuring stable and effective ad campaigns. Each service reviewed here addresses key media buyer needs while complying with Facebook’s policies.

If you prioritize convenience, speed, cashback, and low fees, PSTNET stands out as an all-around solution. For those valuing simplicity and transparent fees, Spendge or Karta might be a better fit.

Meanwhile, FuncWallet is ideal for crypto-focused users, despite its lengthy registration process. Finally, 4×4 offers excellent tools for large-scale advertisers, albeit with strict turnover requirements.

To minimize declines and budget loss, consider factors such as BINs, fees, and funding methods. By assessing your needs and resources, you’ll find the perfect tool to ensure your Facebook Ads campaigns succeed.