Blockchain tech gets a lot of hype for being super secure. It’s built on this decentralized setup where data gets spread out across a bunch of nodes instead of sitting in one spot. A lot of people think that makes it unbreakable. But here’s the thing—no system’s perfect, and blockchain’s no exception. It’s got its weak spots too.

Data breaches in blockchain don’t always look like your typical hack. They can happen because someone messes up, or maybe there’s a glitch in a smart contract that leaves the door wide open. Sometimes it’s just a straight-up attack from the outside. So, let’s dig into how blockchain platforms handle these messes—what threats they’re up against, how they try to stop them, and a few real-life examples that show what happens when things go sideways.

Understanding Data Breaches in Blockchain

In the regular world, a data breach is usually someone swiping your login info or credit card details. With blockchain, it’s a different game. Think stolen private keys—the digital equivalent of losing your wallet—or buggy smart contracts that hackers can poke holes in. Even the platforms where people trade crypto, like exchanges, can be a target.

Now, blockchain comes in two flavors: decentralized and centralized. The decentralized kind uses a shared ledger across tons of computers, which sounds pretty solid, right? It is, mostly. But the apps built on top of it? They can still have cracks. Then you’ve got centralized setups, like crypto exchanges, which are like giant bullseyes for hackers looking to snatch funds or mess with data.

How Blockchain Platforms Prevent Data Breaches

The whole decentralized vibe is a big part of what keeps blockchain safe. Spread the data around, and there’s no single spot for a hacker to hit and bring everything down. If one node gets compromised, the rest keep chugging along like nothing happened.

Then there’s the consensus stuff—fancy terms like proof-of-work or proof-of-stake. Basically, these are the rules that make sure every transaction gets a thumbs-up from the network before it’s locked in. Messing with that takes some serious effort, which is why it’s tough for attackers to rewrite the ledger.

Cryptography’s another heavy hitter here. You’ve got your private key—think of it like a secret passphrase—and a public key that works with it. Lose that private key or let it get nabbed, and you’re toast. Your funds or data are gone unless you’ve got a backup plan.

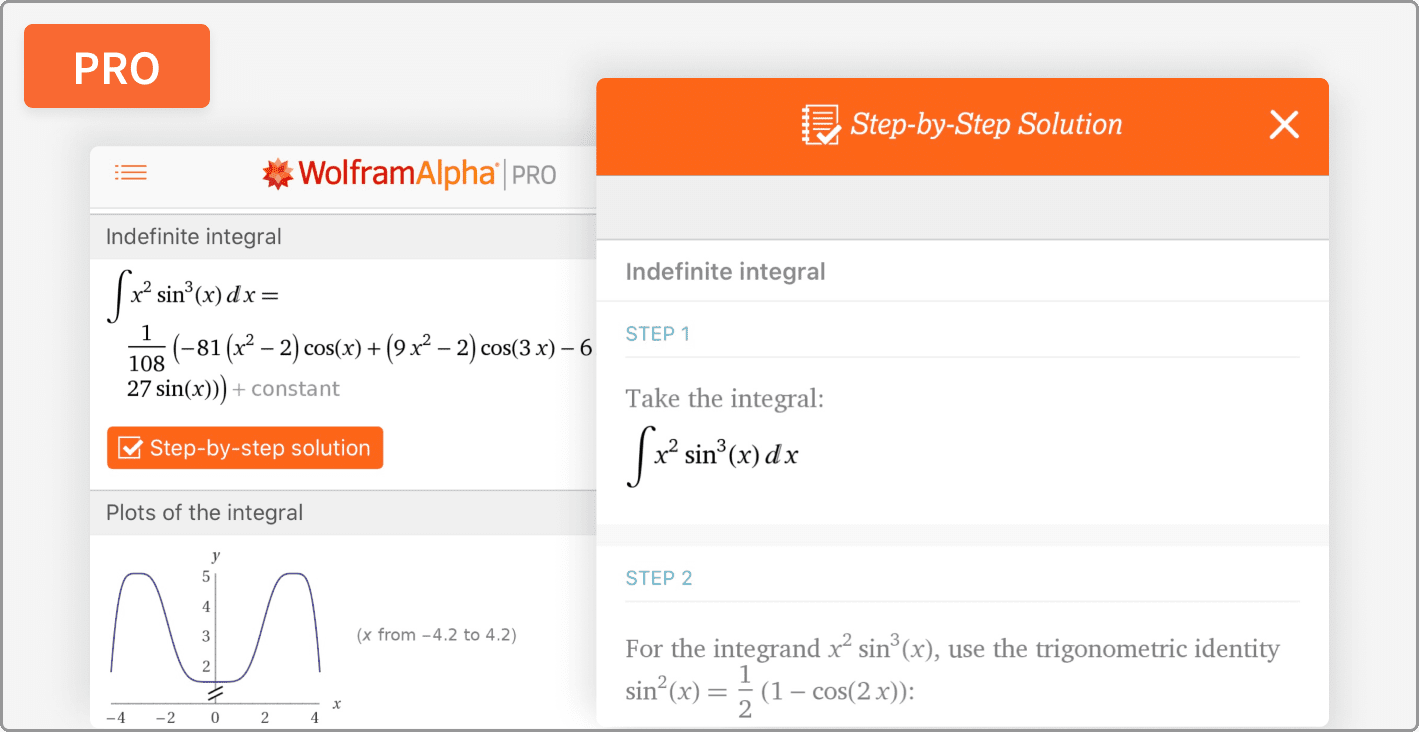

Smart contracts need some love too. Before they go live, developers have to comb through the code, ideally with a third-party audit. Skip that step, and you’re begging for trouble—hackers love sloppy code they can exploit.

Take Sei, for instance. It’s a blockchain built to be fast and secure. It processes transactions in parallel, cutting down on slowdowns that could leave it vulnerable. Faster transactions mean less time for hackers to mess around. Plus, Sei’s got built-in features like finality mechanisms which Sei applications benefit from. This means once a transaction’s done, it’s done. No take-backs or double-spending shenanigans. That keeps fraud and tampering in check.

Responding to a Blockchain Data Breach

Spotting a breach takes some eagle-eyed watching. Weird transaction patterns—like someone suddenly moving a ton of crypto—can tip you off. A lot of platforms use automated tools that ping the team when something fishy pops up.

Once they know there’s a problem, the goal’s to limit the damage. Exchanges might lock down hacked accounts to stop the bleeding. Some bring in security pros to track down stolen assets. Others rush out a patch to plug the hole.

In big cases, you might see a hard fork—splitting the blockchain into two versions to undo the mess. Ethereum did this after the DAO hack to claw back stolen cash. Rollbacks can work too, though they’re tricky. It’s like hitting rewind, but not everyone’s always on board.

There’s a legal side to this too. Governments are cracking down with tighter rules, forcing blockchain companies to step up their security game. That’s good for users—it means better protection and a shot at getting compensated if things go wrong.

Case Studies of Blockchain Data Breaches

The Ethereum DAO hack back in 2016 was a brutal lesson. A flaw in a smart contract let attackers siphon off $60 million in Ether by hitting “withdraw” over and over. The fix? A hard fork that split Ethereum in two—one version kept going as Ethereum Classic, the other rolled back the damage.

Fast forward to 2022, and the Ronin Network got hit hard. Hackers snagged private keys and walked off with over $600 million in crypto. It was a glaring reminder that centralized blockchain services can be sitting ducks.

There’s a laundry list of other breaches too—stolen keys, shaky exchanges, you name it. Every one’s a crash course in what not to do.

The Future of Blockchain Security

The future’s looking interesting. Zero-knowledge proofs are picking up steam—they let you prove something’s legit without spilling the details. It’s a privacy boost that still keeps things trustworthy.

AI’s jumping in too. Smart tools can sniff out trouble as it happens, crunching massive piles of data to spot threats before they blow up.

And regulations? They’re coming down harder. Governments want blockchain companies to play by the rules, which should mean fewer breaches and more accountability.

The Takeaway

Blockchain’s got some serious security chops—decentralization, cryptography, the works. But it’s not bulletproof. Clever attackers keep finding ways to sneak through the cracks.

To fight back, platforms lean on their tech and stay vigilant with monitoring. Those real-world slip-ups prove you can’t slack off. As new tools and ideas roll out, blockchain’s only going to get tougher to crack.