When Bitcoin, the number one crypto-asset, hit the mainstream in 2017, it was a no-brainer to jump into the buying frenzy.

So, we had to set up an online wallet and bear the risk of storing our seed phrases and private keys. Now, that was some hassle securing your Bitcoin BTC.

Then came the 2018 crypto winter. We identified significant reversal structures on the BTC chart, but there was no way to profit from the price slump, as the only futures exchanges back then were the CBOE and the CME futures exchanges.

So, we took a considerable chunk out of our crypto holdings and converted to the USDT, as we still believed in the future of Bitcoin but would love to buy back at a discounted price later in the future.

In this post, we’ll walk you through a step-by-step beginner’s guide on how we scaled up our crypto portfolio by investing in Bitcoin futures and how you, too, can get started.

Let’s dive into it, but first, what are Bitcoin futures.

What are bitcoin futures?

Bitcoin – BTC futures have their values derived from the actual Bitcoin price from the spot markets, and they are termed crypto derivatives.

So, by investing in Bitcoin futures, you do not need to store Bitcoin in crypto wallets, as we explained in the introduction. You can speculate on the increase or drop in Bitcoin price and profit if you’re right on the bitcoin price increase or bitcoin price slump without having the physical bitcoin.

Now I understand what you’re thinking; Bitcoin is a digital and not a physical asset, right?

Well, you’re correct, but we consider having custody of storing your Bitcoin as an intangible, physical act.

Next, let’s jump into other benefits of trading Bitcoin futures.

The benefits of trading Bitcoin futures

You may be wondering, other than taking off the stress of storing my cryptos, where I can easily forget my seed phrase or lose my private key, what else do I stand to gain by trading Bitcoin futures?

Bitcoin Future Trading comes with Leverage..

When you trade Bitcoin on the spot market, you only deal with your funds, which is useful if you’re risk-averse and do not really have an edge in the crypto market.

However, suppose you do have a trading edge and have little capital to work with, plus a reasonable risk tolerance.

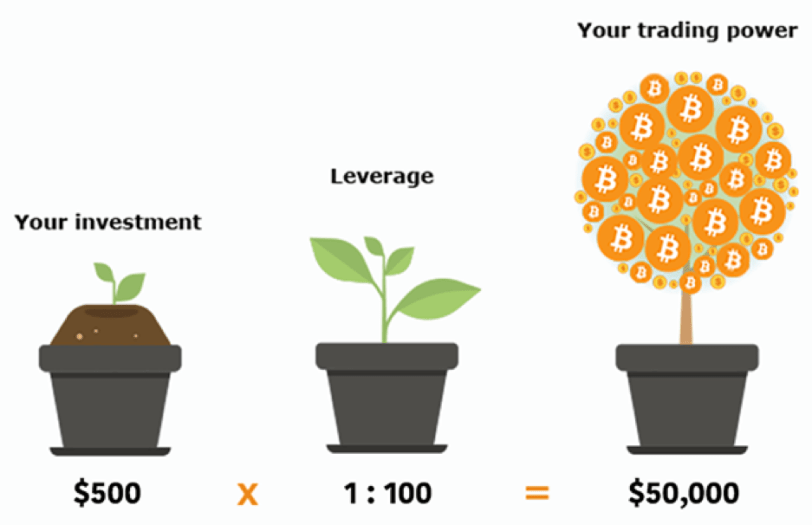

In that case, you can consider trading Bitcoin futures as you can get 2X, 5X, and even 100X Leverage on your initial trading capital.

If you take a 2X leverage on a 500USD account, you get to trade with 1000USD, and a 5X leverage on the same 500USD account would boost your investment capital to 2500USD.

You May Like Bitcoin Leverage & Margin Trading: How to Do It Right in 2021

Place Long and Short orders with Bitcoin futures.

By investing in Bitcoin futures, you do not only get to profit from a rise in the bitcoin price, but you also benefit when you anticipate a price slump and wager accordingly.

On top of that, you can do it with Leverage to boost your capital, as explained earlier.

Short-Selling as a Hedge on your physically held Bitcoin

By taking a short-sell position on Bitcoin futures, you can hedge the risk on your physically held Bitcoin in the event of a price slump like the 2018 crypto winter.

A step-by-step guide on how to buy and sell bitcoin futures on the BTCC crypto derivatives trading platform

Now that you understand what Bitcoin futures are and the benefits of trading Bitcoin futures, we’ll walk you through a seven-step process to trading Bitcoin futures on BTCC which is a 9-year-old crypto exchange and now provides Bitcoin and Ethereum futures trading and the total trading reached 98 billion USDT contracts in the last 30 days.

After you’ve signed up for a trading account on BTCC.com using your email address or phone number, you can launch the trading terminal by clicking on the “Trading” button.

The BTCC crypto exchange offers Weekly and Perpetual BTC futures contracts.

![]()

With the trade terminal window opened, click the drop-down menu like in the image below.

Continue by clicking the perpetual futures contract, which is our favorite as there’s no limitation to how long we can keep a trade open. Keep in mind that we have to meet the margin requirement to avoid liquidation if we experience a drawdown.

Select the BTC/USDT as a perpetual Bitcoin futures contract as displayed above.

STEP 3. Choose an Order Type (Market order or Pending Orders (Limit Order or Stop Order))

Now that you have the main chart window switched to the BTC/USDT perpetual futures contract, you can now advance to choose from one of three order types (Market Order, Limit Order, stop order) from the order panel as shown below.

Market-Order

The Order-Panel

You can place trades as Market orders, which can are buy/sell instant execution orders.

The pending orders are Limit orders (buy limit or sell limit orders) or stop orders (buy stop or sell stop).

Understanding Pending Order

As the name implies, Pending orders are only executed as live orders when the bid/ask price gets to the established price threshold.

You can set a validity period for which your pending order should get deleted if the order is not active.

Limit orders, which can be a buy limit or sell limit, are only active when you anticipate the current bid/ask price to bounce off a set level.

While with stop orders, you anticipate a continuation in the set trend direction.

STEP 4. Select the Leverage that satisfies your trading style/risk appetite

When you buy or sell Bitcoin futures, you do so with Leverage, which gives an extra buffer to your trading account.

You can get Leverage starting from 5X up to 100X on BTCC crypto exchange.

STEP 5. Fill in the Lot Size for the trade

Next, you can type in the lot size for your buy or sell trade on the BTC/USDT perpetual futures contract.

STEP 6. Set the stop loss and take profit price levels by switching on the S/L and T/P toggle switch

Toggle on the set Stop-Limit button to activate the functions for your take profit and stop-loss levels.

You set a stop-loss level to exit your trade in a loss to avoid losing your entire capital if the transaction doesn’t go as planned.

Take-profit is set to lock in your profit when the trade goes in your expected direction, and you’re up in profit.

Lastly, click the Buy BTC/USDT or Sell BTC/USDT button to activate your Bitcoin futures trade either as an instant market order or a pending order.

Conclusion

Ok traders, now you know what Bitcoin futures trading is, their advantages, and how to get started.

You can head off to BTCC crypto derivatives exchange, set up an account right away, and start earning.

In addition to the English market, BTCC is also available in Korean (비트코인 선물거래), Japanese (ビットコイン先物契約), and Vietnamese (Hợp đồng tương lai Bitcoin).